Table of Content

To find your assigned FHFA first-time buyer mortgage rate discount, get a complete pre-approval, including a credit score and income check. Buyers with low credit scores and small down payments get the largest interest rate adjustments on their Fannie- or Freddie-backed loans. A first-time home buyer grant is a cash award paid to new US homeowners. Governments award grants on the local, state, and federal levels.

A mortgage is a loan used to purchase or maintain real estate. With the large amount of money that you’re putting into your home, you’ll want to make sure to take excellent care of it. Regular maintenance can decrease your repair costs by allowing problems to be fixed when they are small and manageable.

Service Contractors

Thats why people are interested in mortgage protection insurance. The best way to determine if youre eligible for a firsttime home buyer program is to reach out to the housing authority in the town or city where you want to purchase a home. And income limits may be based on family size and property location, says Merritt. The cost of mortgage default insurance ranges from 2.8% to 4% of your mortgage amount. The lower your down payment, the more you need to pay in insurance. This fee is usually added to your regular mortgage payments.

This is where a home warranty, especially from 2-10 Home Buyers Warranty (2-10 HBW), can come in handy. A systems and appliances home warranty can cut down the upfront costs of repairs or replacements, making protecting your home simple and affordable. One way to track your financial state is to track your spending. Consider creating a log or spreadsheet that shows how much money you make every month against how much money you spend each month.

What is a First-Time Home Buyer Program?

This income-based loan option requires that you don’t make over 115% of the area’s median income. As a firsttime home buyer, coming up with cash for the down payment and closing costs is one of the biggest hurdles. In addition to these federal loan types and programs, state and local governments and agencies sponsor assistance programs to increase investment or homeownership in certain areas. Real estate commissions represent one of the highest costs at a typical closing. Typically, the commission is 5% to 6% of the homes purchase price, and it’s split evenly between the seller’s agent and the buyer’s agent. Private Mortgage Insurance is an insurance policy that makes homeownership possible for home buyers who don’t want to make a 20 percent down payment.

Your loan options often don’t require you to be a first-time buyer and may include FHA, VA, USDA, and conventional mortgages. While not specifically designed for first home buyers, eligible buyers can be exempt from stamp duty or pay a reduced amount if they haven’t owned a property in the past two years. If you purchase an eligible off-the-plan unit that’s valued at $500,000 or less, you’re exempt from paying stamp duty.

What is a first-time home buyer?

Get pre-approved for the first-time home buyer mortgage rate discount. To search for housing grants available in your area, visit your municipality website, search for “housing assistance” or “housing grants,” and review the program requirements. Here is a collection of first-time home buyer grants and programs available for late 2022. Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website. Your first mortgage payment will come due on the first of the month after you’ve owned the home for at least 30 days (you’ll prepay interest for this period of time at closing).

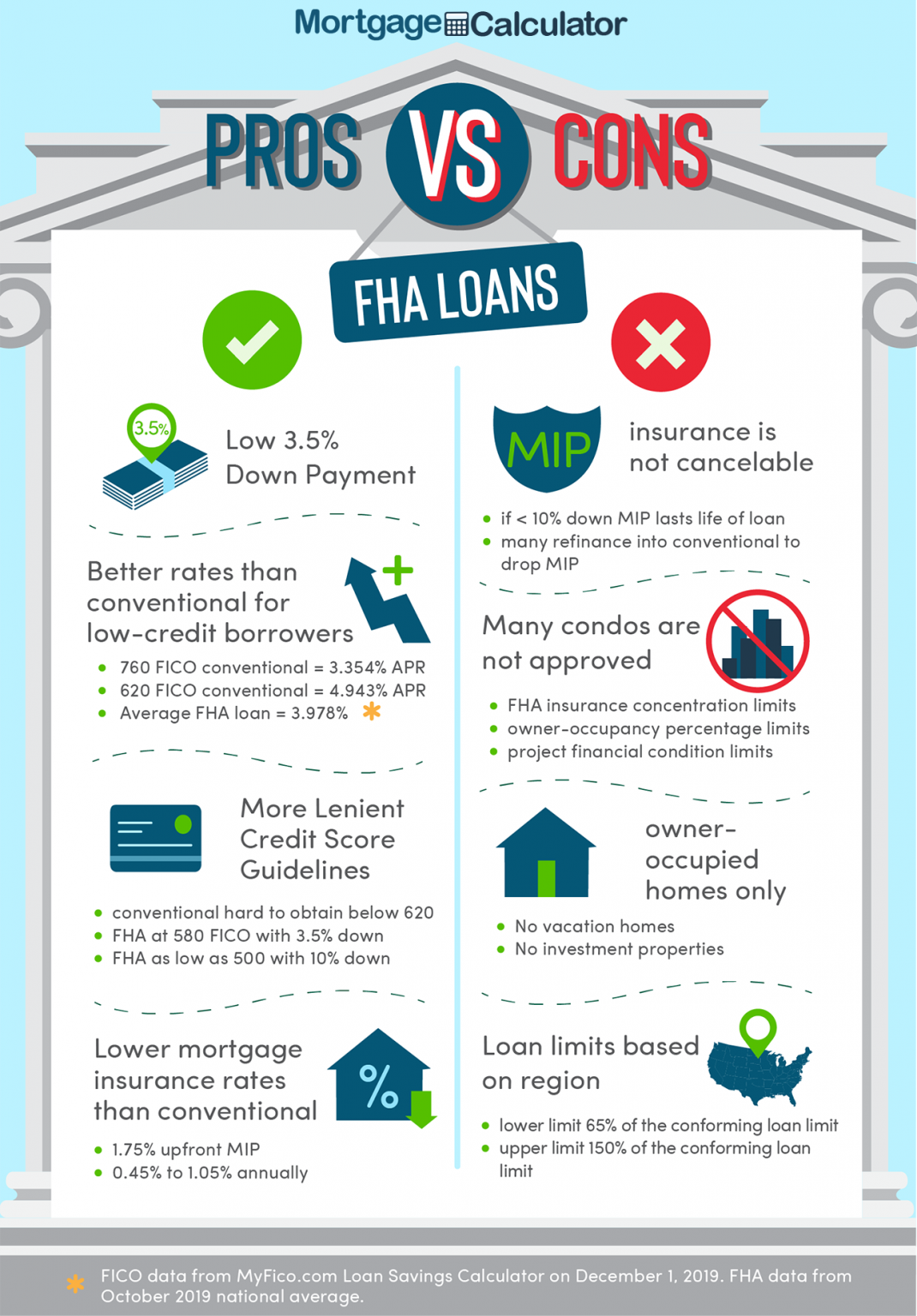

There isn't a down payment requirement, which means first-time homebuyers can get up to 100% financing on a new home. FHA loans, one of the most popular options for first-time homebuyers, are partially guaranteed by that agency. This guarantee gives lenders more flexibility to relax their criteria and offer better terms to first-time homebuyers. Buying your first home can be exhilarating and a tad intimidating.

Your mortgage loan officer will work with you to obtain the Certificate of Eligibility. Our flexible qualification guidelines for VA loans make it a good option for active-duty military members, veterans and their spouses who are looking to buy a home. Borrowers must live in a USDA-eligible area, but they have the flexibility to purchase an attached or detached home, condo, or modular or manufactured home. Borrowers must make 115% or below of the median household income and must have difficulty getting a conventional mortgage without private mortgage insurance . Borrowers with good credit and a 10% to 15% down payment may save money by opting for conventional loans.

One study estimated that buyers using down payment assistance saved almost $6,000 at closing, on average, and another $11,000 over the life of their loans. Mortgage insurance is an extra charge on your monthly housing payment, and it often costs a few hundred dollars per month. Understandably, most buyers would rather avoid paying for mortgage insurance if possible.

Buying a house is a lot to wrap your head around, especially as a first-time home buyer. But if you know what to expect, it doesn’t have to be stressful or confusing. This first-time home buyer guide will help you figure out how much house you can afford and how to finance it, which are the first two steps to buying a home. If you plan to use seller concessions with your upcoming purchase, notify your lender.

When a buyer rolls their closing costs into a mortgage, the buyer is still paying their fees. In exchange for paying the buyer’s closing costs, mortgage lenders charge the buyer a higher mortgage interest to offset its initial cash outlay. VA loans might be a good fit if you have military service and are backed by the Department of Veterans. These loans are great for veterans with low-to-moderate incomes, with little down payment, and who need to finance their closing costs. We have done extensive research on the FHA and the VA One-Time Close Construction loan programs. We have spoken directly to licensed lenders that originate these residential loan types in most states and each company has supplied us the guidelines for their products.

Your lender needs to order an appraisal on the home, and if the home is valued at less than what you offered, you can renegotiate or walk. At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote stricteditorial integrity in each of our posts.

If you’re just beginning your research into the mortgage process, you may be feeling some uncertainty about which type of loan will fit your needs. Luckily, there are first-time home buyer loans with zero or low down payment options and programs that could help you bring your dream of homeownership to life. Here are some options for first-time home buyer loans based on their benefits and affordability. You can use first-time homebuyer loans with other assistance programs that further help with down payment or closing costs. In a red-hot real estate market, a little help with the down payment on a home can go a long wayespecially when youre a first-time buyer without the advantage of equity in an existing property. Available in rural areas and low-density suburbs, the USDA loan is another no-money-down mortgage you can use to finance a home.

Closing Cost Assistance Programs for Home Buyers

In addition, you may use alternative income sources such as rental income for showing your ability to afford the mortgage. Is a terms editor at The Balance, a role in which he focuses on providing clear answers to common questions about personal finance and small business. Has more than 10 years of experience reporting, writing, and editing. As an editor for The Balance, he has fact-checked, edited, and assigned hundreds of articles. It’s important to note that you can only request a release under the FHSS scheme once and it may take between 15 and 20 business days to receive your money. You can make your release request within 14 days of signing a property contract.

No comments:

Post a Comment